In the past few months, transaction fees on the Bitcoin network have skyrocketed, significantly boosting the profitability of Bitcoin mining. This trend was driven by the issuance of MEME coins on the network. Since early May, MEME coins with surging popularity have swept the Bitcoin network. However, unlike previous tokens based on the Ethereum ERC-20 standard, these MEME coins are minted using the BRC-20 standard, which is modeled after ERC-20.

Though based on ERC-20, the BRC-20 token standard is fundamentally different from Ethereum-based token standards. The most notable difference is that BRC-20 tokens do not use smart contracts. Instead, they utilize inscriptions in the Ordinals protocol as interchangeable assets. The minting and trading of BRC-20 tokens require Bitcoin wallets similar to UniSat Wallet.

According to data from OrdSpace, over 37,000 different BRC-20 tokens have been minted on the Bitcoin network. During the peak market period in May, the trading volume of these tokens even surpassed that of Bitcoin itself. Frequent trading by massive users led to a surge in transaction fees on the Bitcoin network, and transaction fees from multiple blocks have even exceeded block rewards in May, which is quite rare in Bitcoin’s history.

Source: OrdSpace

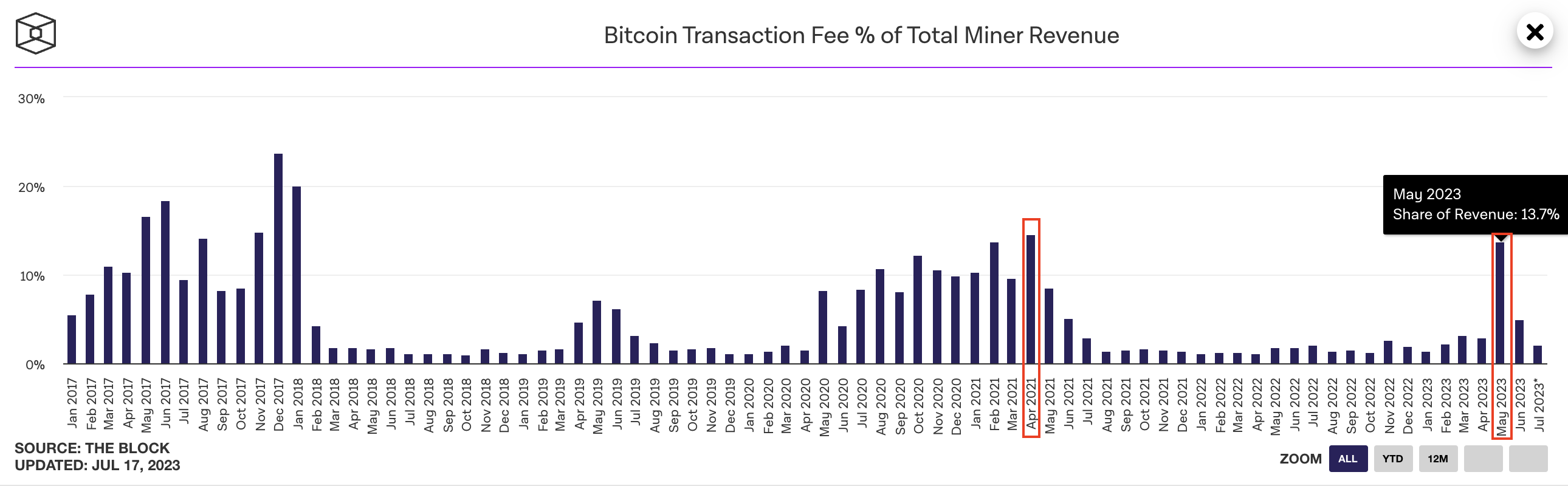

The rising popularity of BRC-20 tokens directly sends Bitcoin miners’ revenue skyrocketing. Daily transaction fees as their income have grown from around 21.8 BTC on April 8 to an impressive 635.3 BTC on May 8, a 29-fold surge within just one month. Data from TheBlock reveals that Bitcoin miners earned approximately $920 million in total revenue in May, 13.7% of which, or around $126 million, came from transaction fees. This marked the first instance since April 2021 that transaction fees surpassed the 10% threshold of the total revenue.

Source: TheBlock

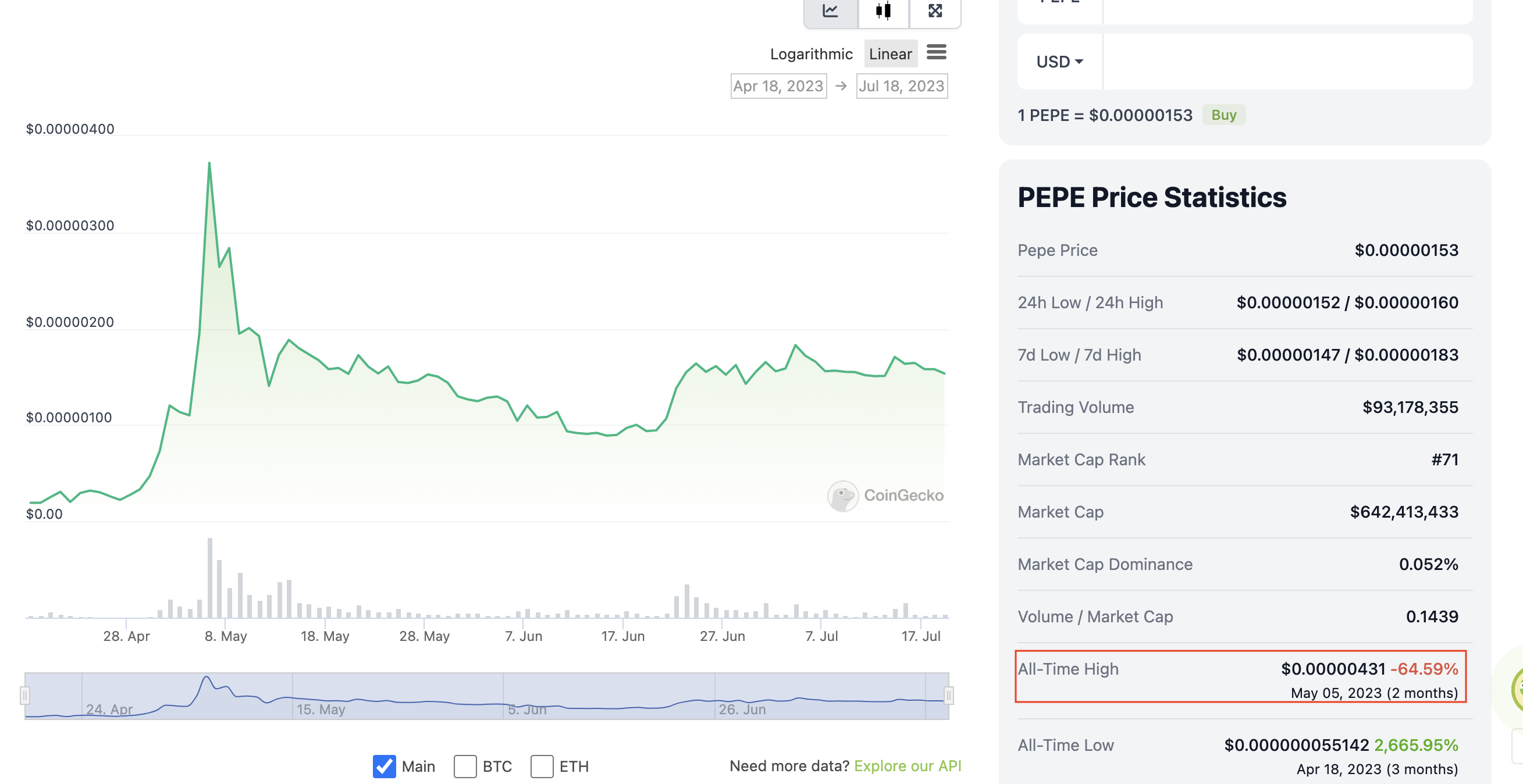

As the initial excitement surrounding BRC-20 tokens begins to fade, the total market cap of these tokens has plummeted by more than 70% to approximately $300 million, from its peak of over $1 billion in May. Prominent tokens in this sector, including ORDI and PEPE, have also witnessed substantial price drops as the hype subsides.

Currently, ORDI is trading at $7.37, a staggering decline of 74.38% from its peak price of $28.52 on May 8;

Similarly, PEPE is currently priced at $0.00000153, a notable decrease of 64.59% from its historical high of $0.00000431 on May 5.

Source: CoinGecko

As the hype surrounding BRC-20 tokens wanes and their prices decline, there has been a decrease in interest among traders and investors to purchase and trade these tokens. This shift is seen as good news for regular Bitcoin users, say, users from countries like El Salvador and Nigeria who have already embraced Bitcoin as a daily payment method. During the peak period in May, the Bitcoin network faced a significant influx of unconfirmed transactions, reaching up to 300,000 transactions per day, and gas fees surged to $30 per transaction. Transaction Accelerator provided by ViaBTC Pool and other such tools became a must to expedite transactions. By contrast, gas fees have now dropped to less than $1, and transactions can be confirmed within 2-3 hours even without additional tools.

Source: Blockchair

Remaining hourly FREE transactions more than 90

Transaction fees received by Bitcoin miners per block are gradually returning to typical levels. Data indicates that in June 2023, transaction fees as rewards were merely $38 million, accounting for less than 5% of the total revenue.

Nevertheless, the decreasing transaction fees have not dampened the enthusiasm of Bitcoin miners. According to relevant data, despite fluctuations, the Bitcoin network has demonstrated a general upward trend in hashrate since this May. Even with the fading hype around BRC-20 tokens, the hashrate has consistently surpassed 400 EH/s for multiple consecutive days in July. The growth in Bitcoin’s network hashrate is closely tied to a major event scheduled for next year—the Bitcoin halving.

Source: HashrateIndex

Based on historical trends observed during Bitcoin halvings, it appears that Bitcoin is poised for another bull market. In the context of professional, large-scale Bitcoin mining operations, miners will face mounting pressure to survive after block rewards decrease to 3.125 BTC. That has prompted major mining companies to deploy more hashing power in an effort to mine as much BTC as possible and accumulate capital before the halving.

Despite the declining interest in BRC-20 tokens and with less than 285 days remaining until the Bitcoin halving, the involvement of traditional financial institutions has pushed the Bitcoin price up to approximately $30,000. With the foundational elements in place for the next upward trend in the crypto market, it is unsurprising that Bitcoin miners are becoming increasingly enthusiastic about their mining activities.

*The above content is for reference only and does not constitute investment advice.